Olympia, WA – April 2024

OCC Reaches 45th Year Anniversary

OCC's Beginnings

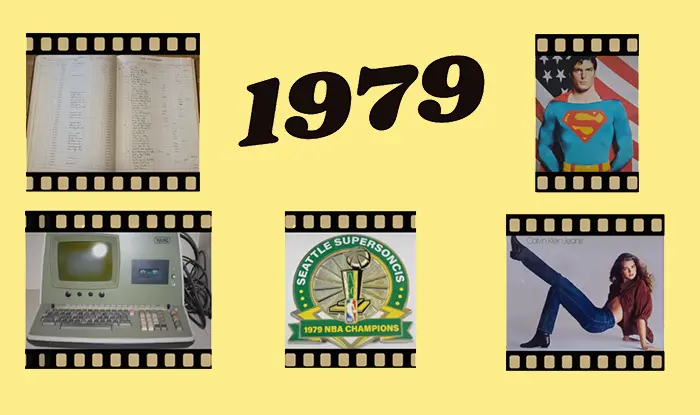

In 1979, Tony Kinninger took a leap of faith and founded Orange Commercial Credit in Anaheim, California. Tony started off with just two employees and was a pioneer in an early industry. In those early days, Tony was a one-stop factoring shop, personally visiting clients' businesses and making weekly rounds with a stack of checks. He funded invoices on the spot while asking for referrals and signing up new business.

Everything was done on handwritten ledgers, with no detail or computer of any kind. A few years later, the OCC operations team participated actively in product development and helped introduce automation to the factoring industry.

As we celebrate our past and look to the future, we carry forward the same spirit of resilience, innovation, and client-centric focus that has defined us for over four decades. Thank you to our clients, partners and dedicated employees for being such an integral part of OCC's journey. We wouldn't be here today without your support.

Olympia, WA – march, 2021

OCC Excellence Recognized with

2021 Best Factoring Company Award

for second straight year

Orange Commercial Credit is excited to announce our selection—for the second year in a row—by FactoringClub. This year OCC is recognized as one of six companies for overall excellence in the Business Category.

OCC caters to a wide range of industries, including, but not limited to:

Business Services • Manufacturing • Transportation, All Modes

• Business Services •

• Manufacturing •

• Transportation, All Modes •

“On behalf of all the team members at OCC—whose hard work and dedication has put us where we are today—we are honored to receive this award for the second year. We are especially proud of the emphasis on customer service, the solid reputation in the industry, transparency and being respectful, as these are all an integral part of our core values,” said Jarrett Pope, Orange Commercial Credit Vice President.

Over one hundred and twenty five factoring companies across the U.S. and Canada were evaluated on their strength in the following areas:

Value

Immediate cash flow for your business with affordable rates and flexible terms

Service

Business relationships with the highest ethical values and principles in the industry

Personal Care

Factoring services with the professional and personal care that you'll appreciate

Proven Track-record

Factoring companies come and go, but these companies have stood the test of time

Quality Service

These factoring companies strive for excellence and deliver quality service to customers

Passion

People that love helping you and your business succeed and grow to the next level

“All our winners have a track record of excellent service and a solid reputation in the factoring community. These factoring companies provide affordable and flexible factoring services to small and medium-size businesses, while helping them grow into more traditional sources of financing. In an industry with many good factoring companies, these companies have achieved a very high standard of excellence,” said FactoringClub owner Rick Hultz.

(Five out of five stars)

FactoringClub is an online resource for factoring companies in North America. Businesses utilize their advanced search capabilities to find the right factoring company for their needs. FactoringClub has more than 125 factoring company sponsors, representing more than 30 states and 50 major cities across the U.S. and Canada.

Olympia, WA – January 13, 2020

OCC Excellence Recognized with

2020 Best Factoring Company Award

Orange Commercial Credit is excited to announce our selection as one of eight companies recognized for overall excellence by The FactoringClub for service in the following industries:

• Business •

• Manufacturing •

• Oil and Gas •

• Staffing •

• Trucking •

Business • Manufacturing • Oil and Gas • Staffing • Trucking

“On behalf of all the team members at OCC—whose hard work and dedication has put us where we are today—we are honored to receive this award. We are especially proud of the emphasis on customer service, the solid reputation in the industry, transparency and being respectful, as these are all an integral part of our core values,” said Jarrett Pope, Orange Commercial Credit Vice President.

One hundred and twenty five factoring companies were evaluated on stringent criteria in the following areas:

Terms

Low startup fees, short-term contracts, selective invoicing and competitive rates

Service

A solid reputation for handling clients with integrity and in a friendly and professional manner

Leadership

Company leaders are experienced and engaged within the factoring industry and community

“All our winners have a track record of excellent service and a solid reputation in the factoring community. These factoring companies provide affordable and flexible factoring services to small and medium-size businesses, while helping them grow into more traditional sources of financing. In an industry with many good factoring companies, these companies have achieved a very high standard of excellence,” said FactoringClub owner Rick Hultz.

(Five out of five stars)

FactoringClub is an online resource for factoring companies in North America. Businesses utilize their advanced search capabilities to find the right factoring company for their needs. FactoringClub has more than 125 factoring company sponsors, representing more than 30 states and 50 major cities across the U.S. and Canada.

Olympia, WA– February 5, 2019

Orange Commercial Credit Reaches 40-Year Milestone

Orange Commercial Credit is celebrating its 40th anniversary in the factoring industry. Launched in 1979 with a singular mission to understand client challenges, solve problems and provide capital to contribute to client success, the firm has posted steady growth year after year. They have grown to offer invoice factoring to clients across all segments of the logistics and transportation industry including trucking, marine and rail. They have also expanded their industry specialization into the staffing, oilfield services, manufacturing, consumer electronics, and building maintenance sectors.

“Our exclusive focus has always been factoring,” said founder Tony Kinninger. “Our longevity demonstrates that professionalism, knowledge, understanding and responsiveness are what clients appreciate. That’s why we are now one of the top factoring companies in the United States.”

The firm began with a personal approach as Kinninger hit the pavement and met with trucking clients in area ports and warehouses to collect paperwork. In the early days, he would personally fund clients at their place of business. With intense dedication, OCC expanded into additional industries serving thousands of clients. As the firm grew, Kinninger opened factoring offices in San Bernardino, San Diego and Olympia, Washington.

In 2010, the three offices merged into one headquartered in Olympia, Washington. Since then, OCC has collectively experienced double digit growth and finished 2018 with their biggest year ever. As CEO, Kinninger is still very active in the company while Jarrett Pope remains the executive vice president and chief operations officer. In 2017, OCC moved into a new headquarters facility in Olympia, nearly doubling their size and positioning OCC for future growth.

One factor in their success is low turnover: the firm boasts an average employee tenure of over ten years. OCC’s operational success lies within employees’ extensive training and keen knowledge of the industries they serve, enabling more efficient service and faster funding. Forty years of experience in evaluating risk across multiple industries also gives OCC an unparalleled advantage in advising clients.

“Our longevity demonstrates that professionalism, knowledge, understanding and responsiveness are what clients appreciate. That’s why we are now one of the top factoring companies in the United States.”

Kinninger reports another key component to OCC’s success has been its continued respect for their clients, including understanding the stress they have on a daily basis to run their companies. This mutual respect has allowed very small companies to grow their sales to exceed a million dollars per month, due to both the hard work of the proprietor and the factor who shares in the risk.

“OCC is very proud of its track record to continually enable its clients to grow and be leaders in the U.S. business community,” Kinninger said. “We see our clients as champions of the small business community whose hard work enables them to live out the American dream.”

“Forty percent of OCC’s new business comes from existing client referrals, which is a huge testament to the superior quality of service clients receive”

At the same time, OCC also has an unusually long client track record – their current oldest client has been with the firm since 1998 and one of their largest clients began working with them in 1999. “Clients stay with us on average five years, while many have been with us more than ten. That’s very uncommon in an industry known for little loyalty beyond the highest advance rate. The industry average client tenure is 18 months. What’s more, 40 percent of OCC’s new business comes from existing client referrals, which is a huge testament to the superior quality of service clients receive,” Kinninger said.

OCC has been a leader in developing an advanced technology platform that enables most clients to receive funding daily. The firm has also been successful in spotting payment trends and positioning their factoring offering in the most competitive way possible while remaining true to their customer service mission.

Looking ahead, OCC has several new systems and technologies in development that will further enhance its ability to better serve clients. Their recently updated website is helping new and existing clients easily find and access their services in the new year. In 2019 they will implement DocuSign and offer an online application that will make setup and onboarding easier for new clients. The firm also plans to expand into new industries in the future and is hiring for new positions in Olympia.