“You should talk to these guys.”

You heard about us from a friend or you found us in a search. However you ended up here, it usually comes down to the same thing:

You need your cash sooner than the

30, 45, or 60-day terms you gave your customers.

The work’s already done. The invoices are out. And your bills are piling up, unpaid, while you’re left waiting.

Trucking. Staffing. Manufacturing.

Different work. Same wait.

Your customer wants 30, 45, or even 60‑day terms. To win the business, you agree. No matter the terms, you still have bills to pay.

Payroll, fuel, insurance,

materials, equipment, repairs...

The bills keep coming, while you wait out those terms. You can charge expenses on a card for a bit, but sooner or later it all comes due.

Wait too long and you’re the one

stuck with late fees or interest.

We're Orange Commercial Credit. What we do is buy the invoices for work you’ve already done. It’s called invoice factoring and we’ve been doing it since 1979.

Through recessions, slow seasons, and the ups and downs of every business cycle, Orange Commercial Credit has been there to provide financial assistance.

You send us your customer's invoice and once it's approved, we send you most of the money up front.

This up-front payment is called an advance. Depending on your industry, it can be as high as 98% of the invoice.

When your customer pays in full, on the next cycle you receive the remainder minus our factoring discount fee, which can range from 1.25% - 5%.

Once you're set up, that advance usually funds within 24 hours. You choose which invoices to sell. Use it when you need it, skip it when you don’t.

You get your money

before payroll or bills hit.

We’ve been through decades of change, but one thing never changes — your bills don’t stop. That’s why your money shouldn’t wait.

Over the years we’ve worked with trucking companies, staffing firms, service providers and manufacturers just like you. Many have been with us five years or more.

They stay because the money’s there when they need it and because they value the service they receive.

They have one dedicated account executive who is backed by an experienced team ready to answer all their questions.

Most of our business comes from referrals. Our clients refer because they know their friends will get the same service they do.

A produce hauler told us what it feels like working with OCC:

“We love OCC! They have taken care of us since 2021. We have the pleasure of working with our account rep. She is such a big help. Always quick to respond to any questions or inquiries we may have. She is always available and I know that I can always count on her. She’s the best! Quick payment, great rates, excellent communication. A trusted company. Highly recommend.”

—Mariya, Owner-Operator, Produce Hauler, Washington

A trucking owner told us how she first came to OCC:

“I turned to my friend Mike for advice and he referred me to his factor… OCC. She reviewed my paperwork and explained step by step what I needed to do including outlining who to contact, what numbers to reference and what I needed to ask.”

—Alyssa, Owner, Long-Haul Trucking Company, Detroit, MI

With us, even if your customer pays on 30, 45, or 60-day terms, you’ll have the cash in your account — usually within 24 hours of invoice approval once you’re established as a client.

One customer. One invoice. One call.

You get a person, not a menu:

1-800-231-3878

The only way this works is if your customer’s good for it. That’s why our credit check matters.

We’ve been doing this since 1979, and many of our credit team members have been here 10+ years. They know how to check credit right.

Our job is to get you paid when you need it.

It’s one thing to hear you’ll get paid...

Here’s what happens, step by step, from the time you send an invoice until the final payment clears.

In invoice factoring, the first thing we do is check your customer’s credit. We pull their payment history up front—even before you send us an invoice—because that’s how we decide if we can buy the invoice from you.

Once they're approved, you send an invoice, and our team then reviews the supporting paperwork that goes with it.

Once your invoice is approved and you're set up as a client, we notify your customer to send payment directly to us and confirm they’ve accepted the change.

It doesn’t change the work you did or the price on the invoice. It updates their Accounts Payable on where to send the payment.

The last step is the funding, the part you care about most.

That’s when the money hits your account.

On every funding you’ll see:

For some industries, we can advance up to 98% of the invoice within 24 hours. On a $10,000 trucking company invoice, that usually means $9,700 to $9,800 up front.

Depending on your company and your industry, we may hold back a small portion of the invoice as a reserve. Not all factoring agreements hold a reserve, but if yours does, it's a small amount set aside until your customer pays the invoice in full. It helps protect you against having to pay us out of pocket for any uncollectible portions of your invoices.

Typically, available reserve balances are refunded (minus our discount fee) on the next cycle following collections.

The discount fee depends on:

Whatever the case, we let you know the fee before you decide — no surprises.

That's how our factoring works.

Ready to see your numbers? Call and we’ll walk you through one invoice on the phone:

1-800-231-3878

The difference with us? We’re independent so we can set your terms the way you need them.

We don’t answer to outside investors. We’re privately held with no board calling the shots. We’re business owners too.

Your terms come from us, and no one else.

We know what it takes to meet payroll and keep the lights on. And we also know that every business is different. We don't drop numbers into a formula.

We base terms on what we see in your invoices and your customers, not on a one-size-fits-all chart.

One flatbed hauler said it best:

“It doesn’t matter if you bring $1 or a million, I guarantee you these people will treat you as a family member. We will always see these people as a great place for financial support and great customer care.”

—Rico, Flatbed Hauling, Illinois

In the end, it comes down to trust. Who do you want to rely on when the bills can’t wait? With us, it starts simple: pick one customer, one invoice, and make one call.

You’re probably asking: So how would this work in my business?

The answer depends on the work you do.

We don’t fund most types of construction, third party medical receivables or consumer invoices. But we have funded companies across more than 50 industries.

We fund invoices for work that’s already done. The goods are already delivered, but your customer’s on terms.

The real issue is when the wait drags well beyond 30 or 45 days.

Let's walk through a few examples in trucking, staffing, and manufacturing—the industries where this matters the most.

You’re here because you’re done waiting to get paid. At Orange Commercial Credit, we buy invoices so that carriers have cash to pay for expenses that won't wait, like repairs, fuel, and detention or lumper fees.

This service is called trucking factoring, also known as freight factoring.

We work with all of them every day

and the story's always the same.

The load’s already hauled. The paperwork’s in. The only thing missing is the money in your account.

And the paperwork looks different depending on the job.

However you haul it, the wait is the same.

The load’s delivered, the paperwork’s in, and you’re still not paid.

Meanwhile, fuel, payroll, and repairs are due now. That’s when you sell us the invoice, and we send the cash.

You’ve seen the ads: same-day funding, fuel cards, mobile apps, even 24/7 payouts. That’s all fine.

So the real question is:

Will the money actually

be there when you need it?

Yes! For clients with approved customers, funds usually go out within 24 hours of invoice verification.

And what about brokers?

You may not know if one’s been paying slow before you book the load.

That’s what our credit team does every day. We flag slow payers before you haul, so you don’t waste miles on a load that won’t pay.

We’ve been doing this since 1979. Many on our credit team have been here more than ten years.

That’s why your paperwork moves fast — and your funds go out on time.

Friday payroll comes due. Fuel card drafts this week. The truck note hits this month.

And the shop won’t release a truck until the repair’s paid. Plus, you need tires and have insurance renewals.

Carry a balance on your card, and the interest adds up.

Fuel bills spike, and drafts hit your account whether or not a broker’s check has cleared.

None of those bills wait.

You need to get paid.

A Pacific Northwest fleet owner put it this way:

“Amazing people working at this company! Always a phone call away always eager to help and always getting the issues solved. Great % rates and overall great people starting from managers to accountants and assistants. Been working with them for over 4.5 years with no problems or complications what so ever.”

—Vitaliy, Oregon

An intermodal freight fleet owner told us what OCC meant for his business:

“Orange Commercial Credit (OCC) was instrumental in our growth from the very beginning. They not only understand the trucking industry but also specialize in the intermodal and drayage business. The funding is quick, the relationships are deep, the rates are fantastic, and the trust earned is invaluable. I have been able to personally recommend OCC to many of our Clients over the past years and have always heard great feedback in return. Thank you OCC for your commitment and friendship. Clients like me really do appreciate it!”

—Michael S., President, Intermodal, Washington, Client since 2013

A long-haul carrier told us why the credit check matters:

“OCC is an exceptional factoring company! Not only do they help us with our invoices, but also advise us on broker credibility, ensuring that we are getting paid for our work. I would like to express my sincere appreciation to my AE for her prompt responses to my inquiries. It makes a real difference.”

—Tom A., Long-Haul Trucking, Texas

Tom’s quote shows what a fleet counts on with credit checks. But when it’s just you and your truck, it’s fuel, repairs, insurance, and the bills waiting at home — all on you.

Fuel card drafts hit every week. The truck note’s coming due. Add shop repairs and home bills. Waiting 30–45 days for a broker to pay just doesn’t cut it.

That’s why we usually send the money within 24 hours; so it’s there before the next bill hits.

Here’s how another owner-operator put it after using OCC for years:

“I'm a small carrier owner operator.

I've been using Orange Commercial Credit for about 4 years now and I couldn't be more happier with the service provided by OCC.

OCC is very fair with their rate and they pay out very quickly (next day).

Their staff is great, very professional and nice.

I recommend OCC for all carriers who need a factoring company.”

—Ezechiel, Owner-Operator, Texas, OCC client since their first load

Ezechiel’s an owner-operator, and the bills don’t wait any less when you’re hauling hot shot loads.

Hot shot runs are smaller, but the bills still stack up just as fast.

Whether you're in an F-350, a Ram, or a Duramax with a gooseneck or bumper-pull, one stretch of repair and fuel bills can drain your cash fast.

You could really use that new Big Tex tandem dual wheel, but trailer payments stack up fast.

And if a broker’s been paying slow, you hear it from us before you waste the trip, not later.

A hot shot driver explained why she sticks with OCC:

“Orange Commercial Credit is an excellent company to work with. They offer exactly what we need to run our trucking company, we always know what brokers are safe to work with due to Orange’s credit check feature. Staff is always friendly and helpful. I have never had a bad experience with our assigned Account Executive or any other staff member for that matter, the whole team is great!”

—Crystal, Hot Shot Trucking, North Dakota

You’ve done the work. You shouldn’t be waiting a month to see the money.

Most clients start with just one customer, one invoice, and one call to us. Even if you just have a question, call us.

We'd be happy to talk with you.

If you run a staffing agency, payroll means two things — the recruiters in your office and the workers already out on site.

Timesheets get signed, checks go out every Friday, and customers may not pay for 30, 60 or more days.

The hours are already worked. Payroll’s due. The money isn’t in yet.

However you staff it, the work is done and you’re still waiting to get paid.

And it’s never just wages. You've got:

Without funding, some owners try to stretch their own payables or pay bills with credit cards. Others dip into personal savings, just trying to bridge the weeks until customers finally send payment.

A staffing owner explained how OCC let him take on more customers:

“I can always count on them. Orange Commercial has helped me take on clients I normally could not afford to take. The setup process with them was easy. They let you choose which clients you want to factor. Pricing is reasonable for the industry. Customer service is great and I can always count on them to send me funds when I need it.”

—George, Owner and Customer Since 2016, Staffing Company in KY

A staffing owner in Illinois told us how OCC changed his cash flow:

“As a staffing company owner, I heavily rely on cash flow to keep my operations running smoothly and meet payroll, OCC's factoring process is incredibly streamlined and hassle-free. Their newly implemented online platform is user-friendly, making it easy for me to submit and track invoices. This new system allows me to receive funds quickly and efficiently, greatly improving my cash flow management. I highly recommend them.”

—Joe, Owner, Staffing Company, Illinois (Customer since 2018)

And that’s how factoring works in staffing. Payroll hits every week, as well as taxes, insurance, and benefits too. With Orange Commercial Credit, the funds are there so that checks go out on time.

You’ve made payroll. You shouldn’t be carrying it for weeks while customers take their time.

Most agencies start with just one customer, one invoice, and one call to us.

Or if you have just one question, call us now and get an answer:

Staffing firms feel it every Friday. Manufacturers do too, just with different bills.

Suppliers want to be paid in 15 to 30 days. Customers take 45 to 60 days and sometimes longer. And they don’t release payment until every piece of paperwork lines up:

By the time you deliver and gather it all, you’ve already cut the checks weeks ago. And you’re still waiting on their payment.

And this is where factoring

helps in manufacturing.

You send the invoice with the paperwork, and we fund you within 24 hours of verification. You don’t wait 45 to 60 days for your customer’s accounts payable to cut the check.

A pallet manufacturer told us how OCC became part of their growth:

“I’ve been working with OCC for over 9 years now and they’re like a partner for me.

I could not have grown my business this quickly without them!

My account executive is great.

I get credit checks done same day on new business and have never had a complaint from any customer.”

—E.H., President, Pallet Manufacturer (Atlanta, GA)

A machine shop owner found that factoring with OCC was "very easy to work with":

“Finding out about OCC has helped keep my business operating with the cash flow I am now receiving. Within a day the money is in my account. During the whole process, OCC was very easy to work with. They made sure I was completely confident and work with me step by step, and the staff is very patient. I would recommend them to any business. Once you start with OCC, you will also be recommending them.”

—Val, Owner and Client Since 2017, NC Machine Shop

Whether it’s pallets, plastics, machining or food processing, if you’ve already delivered and sent the invoice, you don't need to be waiting 45 to 60 days for payment.

With us, you send the invoice with the backup. We review it and send the money — usually within 24 hours.

Pull one invoice from one customer,

and give us a call.

We'll walk you through it.

Call us today.

Here's another benefit to factoring

you may not be aware of:

If you’re a pallet manufacturer sending a quote, a distributor supplying parts, or a service firm chasing contracts, you’ve heard it:

“Can you give us Net-30?”

Sometimes Net-45. Buyers ask for it every day. And if you can’t offer it, they move on. With factoring in place, you can say yes without tying up your own cash.

Longer terms can:

What matters most is whether your customer pays, and whether the invoice is clear, verified, and for work that's already been done.

Things like tax liens or pledged invoices can slow things down, but we'll talk it through with you.

If we can help, we'll say so fast. If not, we'll tell you that too. No guesswork.

Call us and we'll go over one of your customer's invoices together.

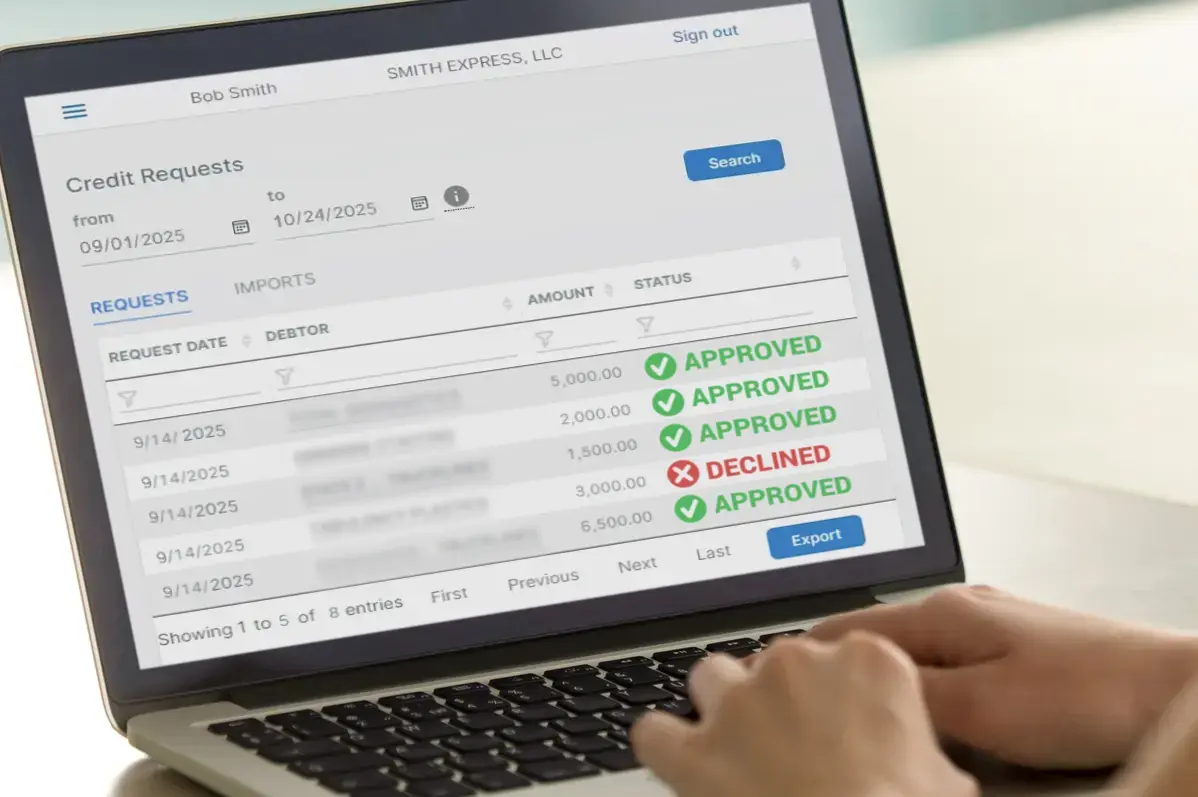

At Orange Commercial Credit, our portal shows every invoice and payment — status, paperwork, and credit — so you always know where you stand.

You don’t have to wonder

if a payment was posted right.

Your paperwork is handled by our team who’ve been here on average 10 years and know your paperwork and your customers.

At Orange Commercial Credit, you get a dedicated account executive. They know you, your business, and your paperwork. When you call, you get answers right away.

You’re not bounced from rep to rep re-explaining the same invoice. You talk to the same person who knows your account, and your funds go out without delay.

A logistics company shared what their experience with OCC has been like:

“We have been with OCC for the last 3 years and have had a great relationship. OCC has been a very important part in our business. With their quick credit information on new prospect customers is the key to eliminate any accounting issues.

"We submit our invoices through their scanning program and are funded same day with no problems.

"We have not had any problems or complaints from our customers as they are very kind and professional to them.

"I highly recommend OCC if you are looking for a reliable and honest Factoring Company.”

—Mary, Operations/Accounting, Logistics Company

No. Invoice factoring isn’t a loan. You sell an invoice for work already done, so there’s no new debt. It’s money that was already owed to you. You just get it sooner.

The discount fee is a percentage of the invoice. How much depends on your industry, your customer's credit history and their payment terms, and the dollar amount of invoices you sell us.

You always see the cost up front before you decide.

No. You choose which invoices to sell. Most clients start with just one, like a $5,000 load that’s already been delivered.

Most of our clients are trucking companies, staffing firms, and manufacturers. But we have funded companies across more than 50 industries.

The process works the same for any business that bills other businesses. However, we don't fund most types of construction, third party medical receivables or consumer invoices.

No. They keep the same price and terms from you.

As the last step in the funding process, we contact your customer to verify the invoice and set up the payment change of address.

If your customer has a question or something’s missing, you work it out with them directly. Once it’s fixed, we move the funding forward.

Most of our team’s been here ten years or more. They spot issues early, so you’re not waiting long once everything’s approved.

But it’s not on you.

We get it.

There’s no setup fee and no obligation,

and most times you’ll have an answer

by the next business day.

If the proposal looks right to you, we'll set up an agreement. We work off a 90-day factoring agreement, but you're never required to submit any certain number of invoices.

It's there when you need it. You’re just giving yourself room to try it and see how it feels.

The agreement lays out the basics:

Once an invoice is approved, the advance is usually sent within 24 hours.

A staffing owner put it this way:

“I can always count on them to send me funds when I need it.”

—George, Owner and Customer Since 2016, Staffing Company, KY

No minimums, no quotas. You decide when to use it.

You also get a dedicated account executive who knows your business and picks up when you call — answering your questions on the spot.

And you can log in any time day or night to check on balances and invoices.

If it makes sense, great. If not, you’ll still leave knowing more than you did before.

And for the owners who don't put it off,

here’s what it looks like.

An intermodal owner told us what makes it work:

“We submit our invoices almost daily using their scanning program, and know that when we submit before the deadline we get same day funding.”

—Mike, President Intermodal Transportation & Warehousing Company, and Customer Since 2006

The money’s in your account typically within 24 hours. Payroll runs, fuel gets bought, shop bills get paid.

That’s why we tell owners:

if the numbers make sense, don’t wait.

Most owners start with just one invoice — enough to see how the numbers work.

In the end it always comes

back to the same thing:

one customer,

one invoice,

one call.

For a real conversation:

1-800-231-3878

🌙

After hours? No problem.

After hours, or if you’d rather not call, fill out this form and we’ll call you back.