“You should talk to these guys.”

— Serving Clients Nationwide Since 1979 —

(also called payroll funding, accounts receivable or A/R financing)

Once your invoice is approved, we usually send your money within 24 hours.

You heard about us from a friend or you searched “staffing factoring” or “payroll funding.” However you ended up here, it usually comes down to one thing: you run payroll every week, but clients pay on terms.

You need your money sooner than the

30, 45, 60, or even 75-day terms you gave your clients.

The hours are already worked. The timesheets are approved. Payday still comes.

Light industrial. Healthcare. IT / professional.

Temp. Temp-to-hire. Long projects.

Different placements. Same wait to get paid.

You agree to terms to win the account. No matter the terms, payroll is still due.

Wages, payroll taxes, workers’ comp,

health benefits…

The bills keep coming while you wait. You can put expenses on a card, but the statement comes due long before your client pays.

Wait too long and you’re the one

stuck with late fees or interest.

So what do you do while you’re waiting?

We're Orange Commercial Credit. What we do is buy the invoices for work you’ve already done. It’s called invoice factoring and we’ve been doing it since 1979.

Through slow seasons and busy seasons, the pattern stays the same: invoices go out, payroll comes due, and your client pays later.

You send us your client's invoice and once it's approved, we send you most of the money up front.

That up-front payment is called an advance. Depending on your industry, it can be as high as 90% or more of the invoice.

When your customer pays in full, on the next cycle you receive the remainder minus our fee, which can range from 1.25% - 5%.

Once you're set up and the invoice is approved, that advance usually funds within 24 hours.

You choose which invoices to sell. Use it when you need it, skip it when you don’t.

You get your money

before payroll or bills hit.

We’ve been through decades of change, but one thing never changes — your bills don’t stop. That’s why your money shouldn’t wait.

We’ve worked with staffing companies across the country. Many of our staffing clients stay with us five years or more.

They stay because the money’s there when they need it and because they value the service they receive.

They have one dedicated account executive who is backed by an experienced team ready to answer all their questions.

Most of our business comes from referrals. Our clients refer because they know their friends will get the same service they do.

A staffing owner explained what it changed for him:

“Orange Commercial has helped me take on clients I normally could not afford to take. Customer service is great, and I can always count on them to send me funds when I need it.”

—George, Owner and Client Since 2016, Staffing Company in KY

With us, even if your client pays on 30, 45, 60, or 75-day terms, you’ll have the cash in your account — usually within 24 hours of invoice approval once you’re established as a client.

One client. One invoice. One call.

You get a person, not a menu:

1-800-231-3878

The only way this works is if your client’s good for it. That’s why our credit check matters.

We’ve been doing this since 1979, and many of our credit team members have been here 10+ years. They know how to check credit right.

Our job is to get you paid when you need it.

It’s one thing to hear you’ll get paid...

Here’s what happens, step by step, from the time you send an invoice until the final payment clears.

In invoice factoring, the first thing we do is check your client’s credit. We pull their payment history up front—even before you send us an invoice—because that’s how we decide if we can buy the invoice from you.

Once they're approved, you send an invoice, and our team then reviews the supporting paperwork that goes with it.

Once your invoice is approved and you're set up as a client, we notify your client where to send payment and confirm they’ve accepted the change.

It doesn’t change your work or your price. It updates your client on where to send payment.

The last step is the funding, the part you care about most.

That’s when the money hits your account.

On every funding you’ll see:

For staffing invoices, we can advance up to 90% or more of the invoice within 24 hours once you’re set up. On a $10,000 staffing invoice, that can mean $9,000 plus up front.

When a reserve applies we set aside a small portion until your client pays. It helps protect you against having to pay us out of pocket for any uncollectible portions of your invoices.

We release the available reserve balance, minus our discount fee, once a month.

The discount fee depends on:

Whatever the case, we let you know the fee before you decide — no surprises.

That's how our factoring works.

1, 2 & 3: You pick an invoice — say a $10,000 invoice backed by approved timesheets, and we verify/approve.

4: We advance most of the money up front, usually within 24 hours on subsequent fundings for that client. The first funding can take longer to get the new client setup.

5 & 6: When your client pays us, we deduct our fee and release the remaining reserve, if any, on the next cycle.

Ready to see your numbers? Call and we’ll walk you through one invoice on the phone:

1-800-231-3878

In staffing, payroll usually means two groups: your recruiters in the office and your workers already out on site.

Timesheets get signed, checks go out every Friday, and clients often pay on 30, 60, or more day terms.

The hours are already worked. Payroll’s due. The money isn’t in yet.

Hours get approved. The invoice goes out. Payroll still hits Friday.

However you staff it, the work is done and you’re still waiting to get paid.

If one missing timesheet signature can delay payment for weeks, this is built for you.

And it’s never just wages. You've got:

Without funding, some owners try to stretch their own payables or pay bills with credit cards. Others dip into personal savings, just trying to bridge the weeks until clients finally send payment.

A staffing owner who's been with OCC for 15 years shared his experience:

“I have been a loyal client of Orange Commercial Credit factoring service for 15 years, and my experience has been nothing short of exceptional. Their professionalism, courtesy and unwavering commitment to our needs have been truly remarkable. They consistently go above and beyond to ensure that my needs are met and their friendly demeanor and genuine care for their clients are evident in every interaction. Their expertise and commitment to excellence have made OCC’s factoring service an invaluable partner for our company.”

—Staffing Company Owner, Client Since 2015

And that’s how factoring works in staffing. Payroll hits every week, as well as taxes, insurance, and benefits too. With Orange Commercial Credit, the funds are there so that checks go out on time.

You’ve made payroll. You shouldn’t be carrying it for weeks while clients take their time.

Most agencies start with just one client,

one invoice, and one call to us.

Or if you have just one question,

call us now and get an answer:

If you run a staffing agency, you’ve heard it:

“Can you do Net-30?”

Sometimes Net-45. Sometimes Net-60. To win the account, you say yes — and payroll is still due every week. With staffing factoring in place, you can say yes without carrying payroll for weeks.

Longer terms can:

What matters most is whether your client pays, and whether the invoice is clear, verified, and for work that’s already been done.

Things like tax liens or pledged invoices can slow setup down, but we’ll talk it through with you. If we can help, we’ll say so fast. If not, we’ll tell you that too. No guesswork. Call us and we’ll go over one of your client’s invoices together.

Call us and we’ll go over one of your client’s invoices together.

No. We’re a factoring company. We fund approved invoices for work already done. If you want an EOR to run payroll and handle HR compliance, that’s a different service.

We’ll tell you the real funding window up front before your setup. Funding depends on verification — approved timesheets, portal approvals (if any), and no open disputes.

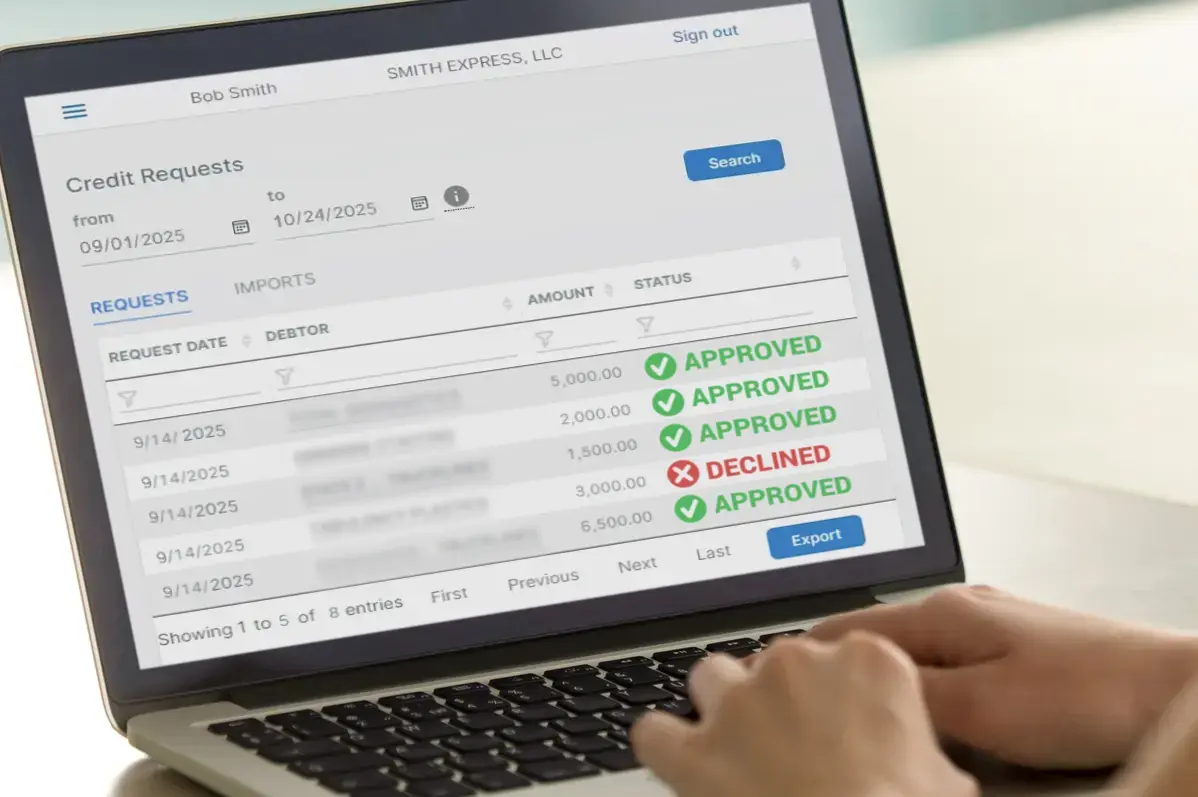

Our portal shows every invoice and every payment — status, paperwork, and credit — so you always know where you stand. You don’t have to wonder if a payment posts.

On staffing invoices, our team reviews the timesheets and backup paperwork and we let you know if we see anything missing so you can resolve it before it affects your funding.

“Their online platform is user-friendly, making it easy for me to submit and track invoices.”

—Joe, Staffing Owner (Client since 2018)

After we verify an invoice, we update your client to send payment to OCC. When their payment posts, the reserve minus the fee releases on the next cycle.

When we spot missing or incorrect billing, funding pauses and we let you know so you can fix it. Once corrected, we verify and fund that invoice.

Usually: the invoice, the approved timesheet (or portal approval), and the basic job details we’re matching (dates, hours, bill rate). If your client uses an MSP/VMS, we match to the portal approval before we fund.

You get a dedicated account executive. They know you, your paperwork, and your clients.

You won't be re-explaining the same invoice to a new person. You call, and you get an answer.

“Our account rep is always at our service… working with him is outstanding.”

—Staffing Client

No. Invoice factoring isn’t a loan. You sell an invoice for work already done, so there’s no new debt. It’s money that was already owed to you. You just get it sooner.

Most staffing factoring is recourse. That means if your client doesn’t pay an approved invoice, you're still responsible for it (the agreement spells out the next steps).

Non-recourse usually only covers a true credit failure (like a bankruptcy). It typically does not cover disputes, timecard issues, missing approvals, or other paperwork problems.

We can point to the exact paragraph before you start, so you know the rule on day one.

The discount fee is based on your client’s payment speed and terms, and how clean the paperwork is (timesheets, approvals, no disputes).

You always see the cost up front before you decide.

No. You choose which invoices to sell. Most staffing agencies start with one weekly invoice backed by approved timesheets.

If you’re comparing staffing factoring companies or invoice factoring for staffing, the basics are the same — but fees, the advance, and how fast you get answers can be very different. We’ll walk you through one invoice and the approved timesheet / portal approval so you can see the advance, fee, and what you’d receive on one invoice.

If you bill other businesses for staffing and your client pays on terms, staffing factoring can work.

We fund invoices for work already done with approved documentation (like timesheets).

Yes — if the work is done and we can match the invoice to approval (timesheets, portal approval, or site sign-off). That includes Facility Management (FM) and Integrated Facilities Management (IFM) setups — staffing labor or cleaning invoices billed through that system.

No. Your client keeps the same price and terms from you.

We verify the invoice and update your client on where to send payment.

If something’s missing, you work it out with your client directly. Once it’s fixed, we verify it and fund that invoice.

Before you call, grab three things. We’ll tell you if we can fund that client and what the advance and fee look like.

A staffing client put it plainly:

“They offer exactly what we need, providing fast funding, transparent pricing, and exceptional services to keep our operations running smoothly.”

—Staffing Client

But it’s not on you.

We get it.

There’s no setup fee and no obligation.

You’ll usually have an answer

by the next business day.

If the proposal looks right to you, we'll set up an agreement. We work off a 90-day factoring agreement, but you're never required to submit any certain number of invoices.

You can start with one client and one invoice. You decide when to use it.

The agreement lays out the basics:

For staffing, that can look like a $10,000 weekly invoice backed by approved timesheets. Once you’re set up and the invoice is approved, the advance is usually sent within 24 hours.

No minimums, no quotas. You decide when to use it.

You also get a dedicated account executive who knows your business and picks up when you call — answering your questions on the spot.

And you can log in any time day or night to check on balances and invoices.

If it makes sense, great. If not, you’ll still leave knowing more than you did before.

And for the owners who don't put it off,

here’s what it looks like.

The money’s in your account typically within 24 hours once your invoice is verified. Payroll is due. Taxes and workers’ comp don’t wait.

That’s why we tell owners:

if the numbers make sense, don’t wait.

Most owners start with just one invoice — enough to see how the numbers work.

In the end it always comes

back to the same thing:

one client,

one invoice,

one call.

For a real conversation:

1-800-231-3878

🌙

After hours? No problem.

After hours, or if you’d rather not call, fill out this form and we’ll call you back.